Safe & Secure Payments

12 months’ Interest-Free Credit from Creation

- Available when you spend £300 or more online*

- No hidden charges

- No arrangement fees

- No deposit required

- Dunelm is a credit broker not a lender. Credit is subject to status. Credit is provided by the lender Creation Consumer Finance Ltd.

- T&Cs apply

*To be able to apply for interest-free credit, you need to have a minimum basket value of £300 (excluding delivery costs).

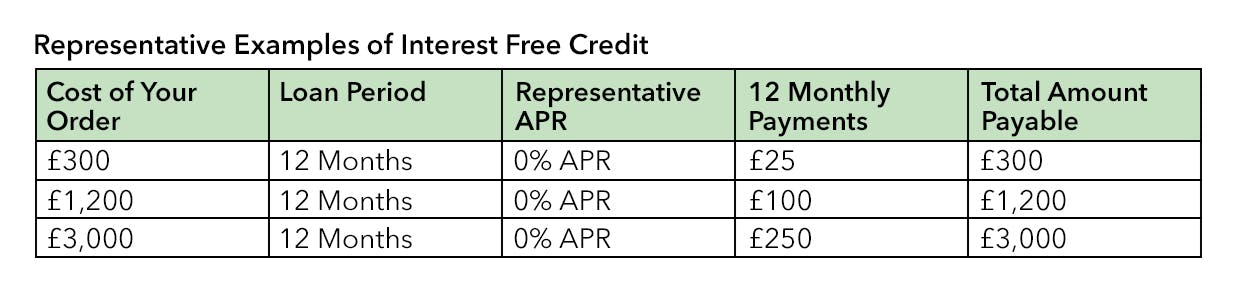

Representative examples of interest-free credit:

Creation Interest-Free Credit: Frequently Asked Questions

Creation is Creation Consumer Finance Limited.

Creation issues personal loans and retail finance directly to customers on behalf of Dunelm and many other high street retailers.

For Creation to consider your application

You need to be:

- 18 or over

- a UK resident for a minimum of 3 years

You need to have:

- an annual income of £10k or more*

- a valid email address

- a mobile phone number

- a valid ID such as a UK driving licence or passport

- a UK bank account which accepts direct debits

*Creation will take into consideration joint income if you’re married, living with a partner or in a civil partnership. Acceptable forms of income are employment salary, self-employed salary and dividends, pension, disability living allowance, employment and support allowance and personal independence payment.

Application process

No – there are no hidden costs, interest charges or arrangement fees.

Yes. You have up to 30 days to sign your contract so the delivery dates you may have seen during your purchase may now be in the past. When you do e-sign your contract, you will then receive a confirmation email that will show accurate delivery date(s).

If you choose to apply for credit, credit and identity checks will be carried out on you, using one or more credit reference agencies.

If you check your eligibility (but before you would be offered credit) Creation will carry out a soft credit check or ‘soft search’. This will allow Creation to see details from your credit report to allow them to make a decision based on your financial situation. This will not affect your credit score.

If you are eligible and you continue your application, a hard credit check will be carried out. This will be seen by other lenders and may affect your credit score.

If your order and credit agreement is cancelled for any reason, as a hard credit check has been carried out, this will leave a footprint on your credit file that will be seen by other lenders.

Yes you can – there’s a 14-day cooling off period during which time you have the right to cancel the credit agreement. Please refer to Creation directly to discuss your rights to cancel your agreement.

If you use your right of withdrawal from the agreement this will not cancel your purchase and therefore you will still be required to pay for goods already dispatched.

The amount you can borrow is subject to eligibility checks by Creation Finance.

Please note that processing Interest Free Credit Orders can take longer than standard debit or credit card transactions. As a result, Dunelm cannot guarantee that stock of your selected product will be available until you receive confirmation that your order has dispatched. Should a product become out of stock then the credit agreement will be cancelled for all items in the order and you will need to start your shopping again.

Managing my credit agreement

Yes – you have the option to repay the credit early in full or in part at any point during the contract.

After a successful application, you’ll be sent details so you can register online with Creation to access their Online Account Management service, so you can:

- Make payments

- See your balance

- View a statement

- Make additional payments

- Pay off your balance early

- Update your contact details

- Change your direct debit date

You can also pay by phone and by bank transfer.

If you fail to make one of your repayments you will incur an additional £30 fee. This will also apply if you pay late or your direct debit fails. The maximum late fees you will incur are £60 in any 12 month rolling period. No interest will be applied to fees. Fees are applied to customer accounts within the first 30 days of the account falling into arrears.

Full details on fees and charges are set out in your credit agreement.

The interest free credit will be repaid over 12 months.

Creation will collect your first payment around one month after you place your order, using the Direct Debit details you provided when applying. Equal monthly payments will then be taken for the length of the agreement. If your delivery takes longer than one month to arrive, your first repayment will be at the end of the month in which you receive your goods.

And it’s important to note that you will not be charged additional fees or any type of interest if all payments remain up to date.

Returning an item / Refunds

Yes - If your item is faulty or damaged you can use our Replacement Process.

Please note that should you return or exchange items, for any reason, or should Dunelm cancel items due to stock availability the remaining value of your order must be higher than 10% of the original credit agreement.

If the item you request a refund for makes up less than 90% of the order total or outstanding balance, a refund can be issued for just that item. If the item you request a refund for accounts for 90% or more of the order total or outstanding balance of the credit agreement, Dunelm will ask you to either:

1. Pay by another means for the remaining item(s) you wish to keep that make up 10% or less of the total order value.

Or

2. Return eligible items purchased using that credit agreement in order to receive a refund. This is due to our credit provider Creation not being able to honour the original credit agreement in this scenario.

When you return part of an order, your refund will appear as a cost reduction to your Creation agreement. You’ll be able to see this by accessing your Creation account online. The refund will be reflected in your remaining balance. You can also check your balance and view your monthly payments, by accessing your Creation account.

Processing Interest Free Credit orders can take longer than standard debit or credit card transactions. As a result, Dunelm cannot guarantee that stock of your selected product will be available.

Should a product become out of stock before you’ve received your dispatch notification, then the credit agreement will be cancelled for all items in the order. If you would like to reorder the products that are available, you will have to place a new order.

Should a product become out of stock after you’ve received your dispatch notification, you will receive a full refund for the items that haven’t been supplied. The refund will appear as a cost reduction to your credit agreement.

To check your balance and view your monthly payments, you can access your Creation account online.

To return a complete order, you can use our usual returns process.

When we’ve received your returns, your credit agreement will be cancelled and any payments you’ve made will be refunded.

If you'd like to exchange what you’ve ordered, you’ll need to follow the returns process, then place a new order and start a new credit agreement. You can’t exchange one product type for another as part of the same order or under the same credit agreement.

This won’t affect your credit history, as long as you arrange your new order and credit agreement within 30 days of your original order.

Questions and concerns

This tool from Citizens Advice can help you work out what you’re earning and spending:

If you have a query or complaint about your credit agreement, you can contact Creation Consumer Finance directly:

By phone: 0371 402 8905

(Lines open 8.30am-5.30pm Monday to Friday, 8.30am-5.00pm Saturday)

Calls may be recorded. Calls are charged at basic rate. The number provided may be included as part of any inclusive call minutes provided by your phone operator.

In writing:

Creation Customer Resolution

Chadwick House

Blenheim Court

Solihull

B91 2AA

At Dunelm, we’re committed to giving you the best service we possibly can. If there’s something you’re not happy with, please let us know so we can try to put things right.

We take all complaints seriously, and we welcome customer feedback so we can keep improving the service we give you. We aim to investigate any complaints quickly and identify the root causes so we can stop the same thing happening again.

If you have any support needs, please let us know so we can help you as needed throughout your complaint.

If we receive a complaint about our 12 months’ interest-free credit product, provided by Creation Consumer Finance, we’ll forward your concerns to Creation in writing. We’ll also contact you to confirm that your complaint has been referred to Creation, and we’ll provide you with Creation’s contact details.

If your complaint is about 12 months’ interest-free credit, you can call Creation direct on 0371 402 8905. Their lines are open Monday–Friday 08:30–17:30 and Saturday 08:30–17:00.

If you’d like to email Creation directly about your 12 months’ interest-free credit complaint, you can use the following email address: complaints@creation.co.uk. For more information about interest-free credit, please visit creation.co.uk.

On the rare occasion your complaint isn’t resolved within 8 weeks of it being received, you’ll be contacted by Creation to explain the reasons for the delay, and they will give you an indication of when you can expect a resolution.

If you aren’t satisfied with Creation’s response, or if you haven’t received a reply, you have the right to refer the matter to the Financial Ombudsman Service. You must contact them within 6 months of the date of the final response letter sent to you by Creation.

If your complaint is about a product you’ve ordered using interest-free credit, you can contact us using any of the following methods:

By phone: 0344 3460020

By live chat: /contact-us

By email: consumercredit@dunelm.com

By post: Customer Service Address, Dunelm Direct, Green Street, Radcliffe, Manchester, M26 3ED

General

A VAT receipt can be requested from Dunelm when your order has been completed and payments on your credit agreement have begun. If you require a VAT receipt this can be downloaded by navigating to 'All Orders' within 'My Account', selecting the order you require a VAT receipt for and selecting the 'Download VAT Receipt' link at the top of the order. Your invoice will be downloaded to your device in PDF format.

If you have not registered with Dunelm, please try Live Chat and have your order number at hand.

You can contact us via our Contact Form.

If you would like to contact Dunelm about an order you have made with a credit agreement from Creation Consumer Finance:

By phone: 0344 3460020

By email: consumercredit@dunelm.com

By post:

Customer Service Address

Dunelm Direct

Green Street

Radcliffe

Manchester

M26 3ED

Dunelm Registered Office

Dunelm (Soft Furnishings) Ltd

Watermead Business Park

Syston

Leicestershire

LE7 1AD

Dunelm (Soft Furnishings) Ltd, acts as a credit broker and not as a lender and is authorised and regulated by the Financial Conduct Authority, registration number 740239. Credit is provided by the lender Creation Consumer Finance Ltd. Subject to status. Credit subject to status for UK residents aged 18 or over.

If you have a query or complaint about your credit agreement, you can contact Creation Consumer Finance directly:

By phone: 0371 402 8905

(Lines open 8.30am-5.30pm Monday to Friday, 8.30am-5.00pm Saturday)

Calls may be recorded. Calls are charged at basic rate. The number provided may be included as part of any inclusive call minutes provided by your phone operator.

In writing:

Creation Customer Resolution

Chadwick House

Blenheim Court

Solihull

B91 2AA

Spread the Cost Options

PayPal Pay in 3

PayPal Pay in 3 is an interest-free loan that lets you split the cost of your purchase into three payments. The first payment happens at the time of the purchase, with subsequent payments due every month on the same date. It’s a simple way to spread the cost of larger items or cover emergencies, and it’s a helpful tool to manage your budget more effectively. Please note that Pay in 3 is a form of credit, so you should carefully consider whether the repayments are affordable, and the possible impact to your credit score. Its use may make credit less accessible or more expensive for you and it may not be suitable for everyone.

Pay in 3 eligibility is subject to status and approval. 18+ UK residents only.

If you choose PayPal Pay in 3 as your payment method when you check out with PayPal, you’ll be taken through the application process. You’ll get a decision instantly. Please note, credit decisions are based on PayPal’s data and Dunelm are not responsible for any decisions regarding the issuing of credit.

PayPal Pay in 3 is an option for eligible purchases between £20 and £3,000

For more information, visit PayPal's Pay in 3 FAQ page.

Pay with Klarna

Klarna lets you split the cost of your purchases. You can now spread the cost of your orders by one of the following choices

Pay in 3

You can choose to pay in 3 instalments - interest-free - using Klarna when you spend between £20 and £2000.

Pay in 30 Days (Pay Later)

You can choose to pay your whole basket 30 days later in 1 instalment - interest-free - using Klarna when you spend between £20 and £2000.

You will receive an email from Klarna when your payments are due, paid and your balance is settled.

If you choose Klarna as your payment method, you will be taken to the Klarna website. You will be taken through the application process and you will need to provide a mobile phone, email address, billing address and a debit or credit card. You’ll get a decision instantly. Please note, credit decisions are based on Klarna’s decisioning engine and Dunelm are not responsible for any decisions regarding the issuing of credit.

Please spend responsibly. Ensure you can afford to make your monthly repayments on time.

Klarna's Pay in 3 and Pay in 30 days (also known as Pay Later) are unregulated credit agreements. Borrowing more than you can afford or paying late may negatively impact your financial status and ability to obtain credit. 18+, UK residents only. Subject to status. Ts&Cs and late fees apply. klarna.com/uk/terms-and-conditions.

Klarna Frequently Asked Questions

Klarna is a payments service that helps you buy the things you want or need. Right now, over 100 million people worldwide use Klarna at over 200,000 online stores.

Klarna’s Pay in 3 instalments is a credit product that lets you spread the cost of your purchases over 3 equal payments. Klarna will take the payments from your debit or credit card directly so you don't have to worry about missing a payment. Klarna will take the first payment when you make the purchase, the second 30 days later and the final payment 60 days from your purchase date. You can see your past and future payments at any time using the Klarna app.

Klarna’s Pay in 30 days (also known as Pay Later) is a credit product that lets you delay paying for your whole basket for 30 days. Klarna will take the single payment from your debit or credit card directly so you don't have to worry about missing a payment. Klarna will take the payment 30 days from your purchase date. You can see your past and future payments at any time using the Klarna app.

You need to be at least 18 years old and a UK resident to use Klarna’s credit products including Pay in 3 instalments and Pay in 30 days. When you choose Klarna they will also check the information you provide and your financial situation.

Yes, you can. If you see Klarna Pay in 3 / Pay in 30 days when you go to an online checkout then it is available to you. Every time you use Pay in 3 or Pay in 30 days, Klarna will check to see whether you can use it again for each additional purchase.

Before lending, Klarna considers a number of factors such as the purchase amount, and previous order history. You can improve your chances of being offered Klarna products by ensuring you provide your full name, accurate address details and arrange shipping to your registered billing address. All orders are assessed individually. Just because you have been accepted for Pay in 3 / Pay in 30 days before does not mean it will be offered for every order. In turn, if your application for Pay in 3 / Pay in 30 days is denied, it does not mean it will be denied for future orders.

If you want to purchase something using Klarna, you'll need to share your phone number, email address, current billing address and your credit or debit card details. If Klarna need to talk to you urgently they'll use the phone number you've shared. For any other information Klarna need to share with you, they'll send this to your email address.

When you select Klarna then Klarna will perform a credit search. This means Klarna will look at certain information in your credit report to decide whether to approve your purchase.

Klarna will take your instalment payments from the debit or credit card you shared when you made your purchase. For Pay in 3 orders, Klarna will take the first payment when you make your purchase, the second payment after 30 days and the final payment 60 days from the day you made your purchase. For Pay in 30 days orders, Klarna will take the full payment 30 days from the day you made your purchase. You can see both past and future payments using the Klarna app.

Yes. Just go to the Klarna app or log onto Klarna.com/uk.

Payment information is processed securely by Klarna. No card details are transferred to or held by Dunelm. All transactions take place through connections secured with the latest industry standard security protocols.

Klarna will notify you by email and push notication when a payment is due and when you have made or missed a payment. You can always check the status of your order and payments in the Klarna app or by logging in at www.klarna.com/uk.

Pay in 3 / Pay in 30 days (Pay Later) are credit products and you are required to make your scheduled payments to Klarna.

If you don't make your payments you will be in arrears as Pay in 3 and Pay in 30 days are credit products. Klarna may then share information about your missed payments with credit reference agencies. This means you may find it difficult or more expensive to use Klarna or other lenders' credit products in the future.

If you have not received your goods please call Dunelm to check on your order and delivery status. You can also contact Klarna’s Customer Service so that they can postpone the due date on your payment or put the order on hold in the Klarna app while you wait for the goods to arrive.

As soon as Dunelm has confirmed with Klarna that your cancelation / return has been accepted, Klarna will cancel any future scheduled payments as well as refund any amounts due. You will see the return in the Klarna app immediately.

As soon as the store has registered your cancelation or your return, the refund will normally be processed within 5 business days.

Refunds will be issued back to the debit or credit card which was originally used at checkout.

Once Dunelm has received the return and Klarna have received our confirmation, Klarna shall refund any payments collected and cancel any future scheduled payments. You are always able to monitor the status of your order in the Klarna app.

Once Dunelm has received the partial return and Klarna have received our confirmation, an updated statement with an adjusted payment schedule will be sent to you by Klarna. You are always able to monitor the status of your order in the Klarna app.

You can log in the Klarna app or at www.klarna.com/uk, where you will see all of your orders and payment schedule information.

Visit the Customer Service page in your Klarna app for a full list of FAQs, live chat and telephone options.

Klarna’s Pay in 3 / Pay in 30 days (Pay Later) are credit agreements that are not regulated by the FCA. Use of these and any missed payments may affect your ability to obtain credit from Klarna and other lenders. 18+, UK residents only. Subject to status. Ts&Cs and late fees apply.

VAT Receipt

Can I have a VAT Receipt for my order?

If you require a VAT receipt this can be downloaded by navigating to 'All Orders' within 'My Account', selecting the order you require a VAT receipt for and selecting the 'Download VAT Receipt' link at the top of the order. Your invoice will be downloaded to your device in PDF format. If you have not registered with Dunelm, please try Live Chat and have your order number at hand.

Secure Online Payment

- All prices include VAT (where applicable).

- We accept online payments in a secure environment by credit/debit card, or via UK-registered PayPal accounts. We accept all major credit and debit cards, with the exception of American Express.

- When your order’s confirmed, only the last four digits from your credit/debit card will be revealed.

- Customer security is our highest priority, and we’ve invested in 3D Secure to give you complete peace of mind.

- 3D Secure is a security measure that gives online payments an additional layer of protection. This extra step before you complete your order protects your card from fraudulent use online.

- When you submit your card details, you may be directed to an authentication page on your card provider’s website. Authentication could be via a one-time password or a face/fingerprint scan (if you’re using a mobile). Authentication pages are on your card provider’s secure servers, and Dunelm won’t be able to see or access this information at any stage.

- When paying by credit card for transactions above £100 in the event you have a complaint and Dunelm are not able to resolve your complaint you have the option to refer the matter to the Financial Ombudsman Service.